Closing Ireland’s green infrastructure gap

15 November, 2022

PwC Global has developed a green infrastructure finance propensity index for 61 of the world’s largest countries. The index identifies country-specific pathways for private finance to help deliver the infrastructure needed for decarbonisation. Energy, industry and buildings account for more than 70% of global greenhouse gases, and decarbonising these sectors will require substantial infrastructure investment. Public funding alone is not sufficient, as we have written previously. For private finance to be deployed effectively, governments must take the lead by providing both public funding and a robust policy framework. In this insight, we used the same criteria of this global analysis to understand what Ireland's green infrastructure finance propensity index would look like.

To inform our analysis, we compared Ireland’s green infrastructure finance propensity score to a sample of 14 developed countries. We also divided the sample into two groups: EU member states and common law countries, reflecting the legal and economic environments that exist within each group. In being both an EU member state and a common law country, Ireland holds a unique position within the sample. Our analysis serves as a useful tool for policymakers in determining where to concentrate their efforts to ensure Ireland’s transition to a net zero economy.

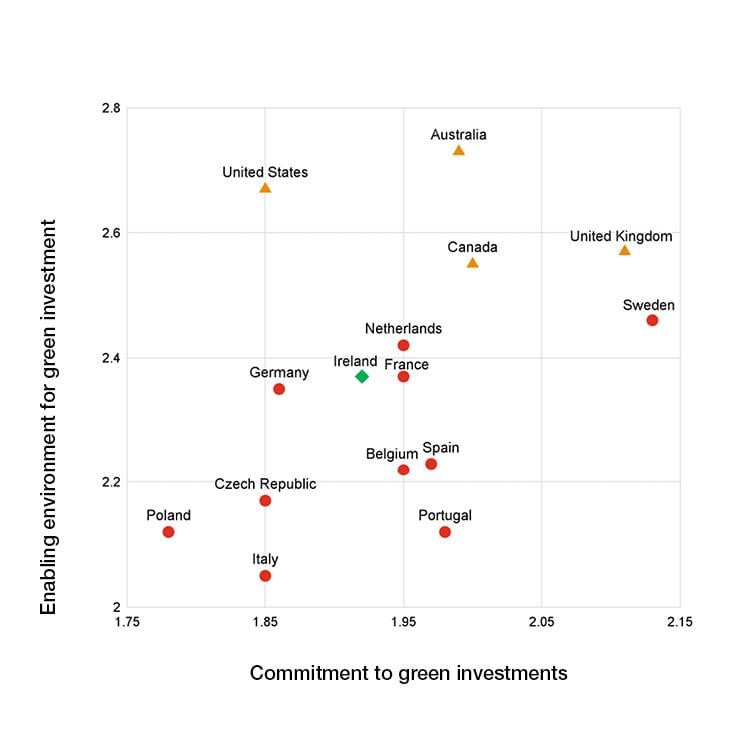

Figure 1: Green infrastructure finance propensity index

The results of our analysis are best summarised by Figure 1. The chart plots the performance of all 15 countries across two dimensions—the enabling environment for green investment and the commitment to green investment. The enabling environment for green investment considers whether a country’s macroeconomic fundamentals and the opportunities provided by its financial market enable new financial commitments to sustainable infrastructure assets. This dimension consists of three factors: the macroeconomic environment, the strength of the financial market and green financing opportunities.1 The overall commitment of a country’s government to the realisation of green infrastructure is measured by its commitment to green investment. The factors that underpin this dimension are green growth (emissions and renewable energy), the regulatory environment and commitments to green objectives.2

It is important to note that, from a global perspective, all 15 countries in the sample perform well. Nonetheless, improvements can be made. Countries that score higher in both dimensions, such as Australia, are better positioned to close their green infrastructure gaps than others. This analysis can inform targeted interventions by policymakers that enable them to close the infrastructure gap as efficiently as possible. Ireland is close to the median score of the other 14 countries in the sample across both dimensions. This points to a considerable opportunity to improve Ireland’s commitment to green investment and to better enable that investment.

Through our analysis of the underlying data, we have identified three broad measures to help Ireland move into the top right quadrant and close its infrastructure gap.

First, Ireland should ensure that its pipeline of green infrastructure investment opportunities is sufficiently ambitious to achieve net zero emissions on schedule, while also ensuring that the pipeline is credible. Second, the planning regime should be reformed to enable the delivery of the green infrastructure within that pipeline. And third, sufficient public funding must be made available to ensure the timely delivery of the infrastructure.

These measures should not be seen in isolation, but as part of an overall solution. Failure to put in place any single element could undermine success. We discuss these measures in more detail below.

Green infrastructure pipeline

Project Ireland 2040, which consists of the National Development Plan (NDP) and the National Planning Framework (NPF), is a central plank in Ireland’s strategy for decarbonisation.3 The revised NDP includes plans for €165bn of investment up to 2030. While work has begun on the delivery of elements of this plan, certain actions that would enable the involvement of further private finance have yet to be completed. For example, one action that was targeted for Q2 2022 but is yet to be completed is the review of the use of the public private partnership (PPP) model in delivering NDP projects. A second is the publication of guidelines in relation to the use of energy performance contracts (EPCs) for energy efficiency upgrades to buildings.

Planning reform

The infrastructure delivery challenges presented by Ireland’s planning regime are widely discussed. As Ibec noted in a recent report, “efforts by Government and business to address… inadequate infrastructure are being hindered by a planning regime that is unnecessarily costly, slow and cumbersome”.4 There is a need for a simplified and streamlined planning process; greater consistency of approach across local authorities; increased political leadership in conveying the importance of proceeding with the development outlined in the NDP; and efforts to provide an adequate, fair and transparent appeals processes without immediate escalation to the courts. The Maritime Area Planning Act is an encouraging step forward in this regard, but further reforms are necessary. It is also important to ensure that planning authorities are adequately and competently resourced.

Public investment and supports

In addition to providing opportunities for investment through the green infrastructure pipeline and implementing the enabling framework, the Government must provide sufficient funding to ensure timely delivery. Public investment not only has the direct effect of ensuring that a project gets off the ground, it also sends a signal to the market that the pipeline is credible and worth the attention of private investors. Public investment also de-risks projects, which is particularly important where new technologies are being deployed at scale. The Government’s recent approval of the terms and conditions of the Offshore Renewable Energy Support Scheme (ORESS) auctions is an example of how government intervention can significantly influence the market.5 Expanded use of such support schemes to encourage the deployment of renewable energy, energy storage and carbon capture technologies is to be encouraged. Greater use of green bonds to finance infrastructure projects, along with carbon taxes to fund them, provides opportunities to private investors while also dis-incentivising carbon-intensive activities. Coordination with partners across borders and industries, and between the public and private sectors, is key to effective and efficient decarbonisation.

Footnotes

1Macroeconomic environment: S&P sovereign risk rating score, Gini coefficient and GDP growth (2016–26). Strength of the financial market: Sharpe ratio (2016–21), non-performing loans to total gross loans, domestic credit to private sector as a percentage of GDP, country risk premium and equity market capitalisation as a percentage of GDP. Green financing opportunities: pipeline of green investment opportunities (2022 onwards), number of green bonds issued and green ODA availability.

2Green growth: population growth (2020–50), CO2 per unit of GDP and renewable energy production as percentage of total energy production. Regulatory and business environment: OECD carbon pricing score, green incentives and ease of doing business index. Commitment to green objectives: companies that set science-based targets towards net zero and government nationally determined contributions (NDC) commitments.

4Better planning: reforms for sustainable development, Ibec.

Data sources

S&P Group, World Bank, IMF World Economic Outlook, Investing.com, NYU Stern, Fitch Solutions, Climate Bonds Initiative, OECD, Wittgenstein Centre, SBTi, Climate Watch and proprietary PwC sources.

Menu