Overview

While many businesses survived the pandemic, they emerged with challenging balance sheets. Irish businesses face a number of difficulties, including high inflation, increasing interest rates and higher energy costs. As the Government’s COVID-19 supports are gradually reduced and debt recovery gathers pace, we expect to see more restructuring activity in the coming quarters and years.

Business failure insights

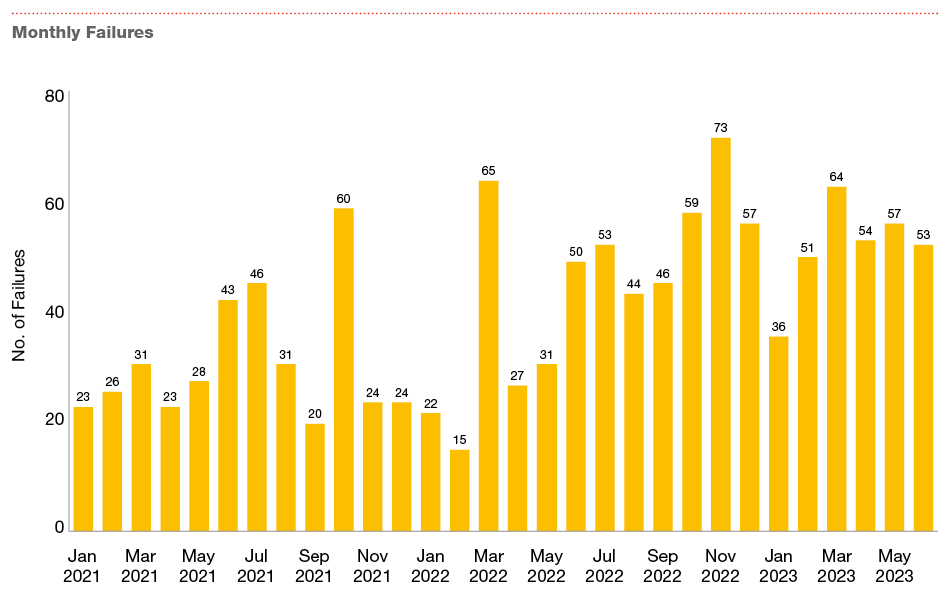

There was a 54% increase in insolvencies during H1 2023 versus H1 2022. Furthermore, insolvencies are 79% higher now than they were at their lowest level during the pandemic.

The success rate of SCARP

Approximately three out of every four SCARP applications have been successful since the process’s inception at the end of 2021. Appointments remain low, however, and account for less than 5% of all insolvencies since it was enacted.

Revenue debt warehousing update

Over 6,000 companies that availed of the debt warehousing scheme owe an average of €300,000 each. These companies have until May 2024 to make repayment arrangements with Revenue.

Insolvency levels pick up in the US and UK

The UK recorded a 40% year-on-year increase in insolvencies in May 2023. Meanwhile, the US experienced the highest number of companies filing for bankruptcy in over a decade.

Dublin continues to account for roughly half of all insolvencies

Dublin had the highest number of business failures, with 50% of the total during the first half of the year. Dublin has, on average, accounted for roughly 50% of total insolvencies for the past number of years.

Five ways to optimise your company’s cash culture

In the face of general market disruption, geopolitical change and high-profile challenges across different industries, businesses feel the effects of an uncertain market. Restructuring activity is rising, and the risk of shocks persists. Creating a cash-conscious culture will help organisations become more resilient, mitigate risks and flourish in the future. To achieve this, everyone in an organisation must focus on cash. It is a collective responsibility that encompasses the boardroom and all levels of the business. It is not for the finance team or treasury to make decisions that impact cash flow in isolation.

- Make cash the business of everyone in the organisation

Cash is bigger than the treasury and finance departments. They both have a key coordinating role in effectively managing cash, but the business’s operations make daily decisions that impact cash. Put cash at the top of everyone’s agenda.

- Cash can mean different things to different people, so make cash relevant to everyone

A common language for cash across the organisation (operations and finance) is vital to instilling a proactive cash-conscious culture. It can lead to:reliable cash forecasting;- effective expenditure management and tactical actions;

- cash reporting and incentivisation, tailored to audiences across the organisation;

- management of cash tax and government incentives;

- centralising management of true cash availability and foreign currency cash; and

- effective management of banking and other financing facilities.

- Forecast cash and scenario plan at an appropriately granular level

This should be conducted on a medium- and short-term basis and involve operations and finance teams. These are essential in reflecting and understanding the real operational risks in the current volatile market. - Understand and share your minimum cash thresholds

Doing so will help the wider business manage its daily decisions and cash commitments (once the decision is made, the cash is committed).

- Optimise supplier and customer working capital terms and relationships

This will help conserve cash and generate the cheapest form of cash available to you.

We are here to help you

The months and years ahead will undoubtedly be challenging for many Irish businesses. We are ready to help you. Contact us today.

Menu