Ireland has seen a decrease in business failures from Q4 2022 to Q1 2023. There was a 32% decrease quarter-on-quarter in the total number of insolvencies—119 companies in Q1 2023 compared to 175 companies in Q4 2022. However, there was a 23% increase in the total number of insolvencies compared to the same quarter last year—119 companies in Q1 2023 compared to 97 companies in Q1 2022.

Quarterly update—Q1 2023

There was a 23% increase in the total number of insolvencies when comparing Q1 2022 and Q1 2023—119 companies in Q1 2023 compared to 97 companies in Q1 2022.

There was a 32% decrease in the total number of insolvencies from Q4 2022 to Q1 2023.

With four SCARP appointments this quarter, SCARP accounted for just 4% of the total insolvencies during Q1 2023. This contrasts with Q4 2022 when 12 SCARP appointments were recorded, accounting for 7% of total insolvencies during that quarter.

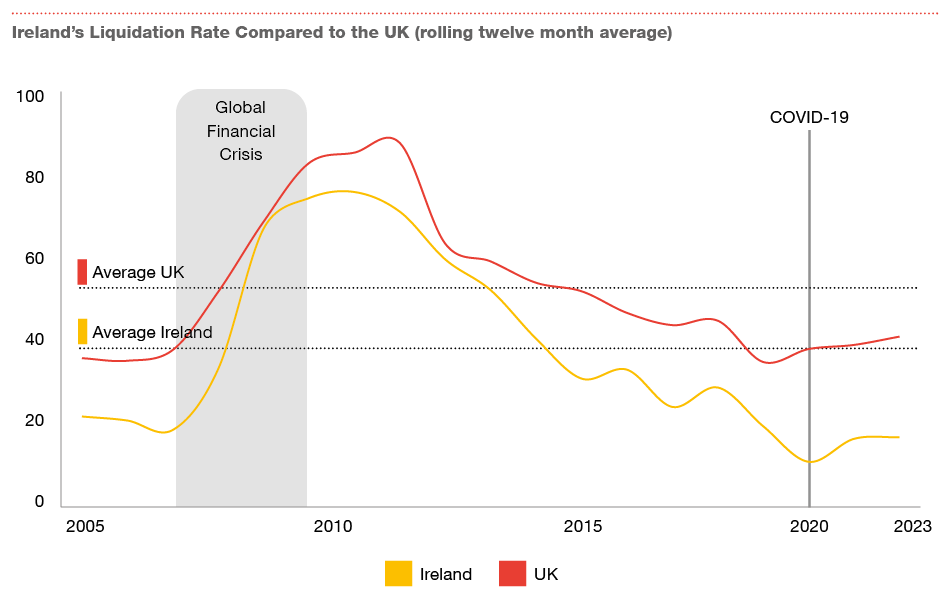

Business failures in the UK

As highlighted in previous reports, the first two quarters of 2022 saw a record number of liquidations in the UK, which is comparable with trends not seen since the global financial crisis. After a plateau in Q3 2022, the figures rose in Q4 2022 with 5,898 recorded liquidations. This is an increase of 8.4% in Q4 2022 from Q3 2022 when 5,443 liquidations were reported.

Q1 industry and county insights

In Q1 2023, the arts, entertainment and recreation sector had the highest number of business failures with 21 failures per 10,000 businesses.

Kilkenny had eight business failures per 10,000 businesses during Q1 2023. Dublin and Kildare followed with 7 business failures per 10,000 businesses each.

Key actions to take now

Assess your working capital

Companies must reappraise and shore up their liquidity and working capital requirements to address the unwinding of government support and debts accrued during the pandemic, while meeting renewed customer demand and delivering delayed investment.

Identify multiple funding sources

The limited availability of further government support will increase reliance on existing lenders, shareholders and access to the capital markets, which may be less forthcoming in sectors where the prospects for recovery and long-term growth are less clear.

Monitor your cash flow

In this uncertain and potentially stop-start pathway to recovery and economic growth, it is essential to monitor cash flow. Companies must develop realistic forecasts that take account of potential varying recovery scenarios and, in particular, increasing rates of inflation in Ireland and around the world.

Consider the future

The immediate demands don't just include day-to-day expenses, but also funding for future growth and adapting to the trends reshaping marketplaces and economies.

We are here to help you

The months and years ahead will undoubtedly be challenging for many Irish businesses, but we are ready to help you. Contact us today.

Menu