Insolvency rate heads back to pre-pandemic levels

Insolvencies rose by over a third in Q1 2024 compared to the same quarter in 2023. The number of business failures have more than doubled from 102 recorded in Q1 2022 to 223 recorded in Q1 2024. There was also a 41% increase in the total number of insolvencies recorded when comparing 223 in Q1 2024 and 158 in Q1 2023.

Our PwC Insolvency Barometer shows that we’re slowly returning to pre-pandemic levels. The current annual business failure rate is 28 per 10,000 businesses compared to 36 per 10,000 businesses in 2019.

Although the current rate has almost doubled since 2021, when the rate was 14 per 10,000 businesses, it remains well below the previous peak of 109 per 10,000 businesses back in 2012.

Furthermore, if the rising trend of insolvencies continues over the next three quarters, 2024 is on track to exceed the pre-pandemic levels of 850 recorded insolvencies in 2019.

SME liquidations continue to be the main driver of the increase in insolvencies

Liquidations made up 85% of all insolvencies in Q1 2024. As in previous quarters, it is the number of liquidations that are driving the rising insolvency levels. In fact, there were three times more liquidations in Q1 2024 (189) compared with Q1 2022 (63).

Rescue processes (examinerships and SCARPs) made up just 3% of insolvencies in Q1 2024 compared to 6% in Q1 2023

Q1 2024 saw 2 examinerships and 5 SCARPs, compared to 2 examinerships and 8 SCARPs in Q1 2023. These rescue processes continue to be underutilised and the relatively low numbers during Q1 2024 may have been impacted by the extension of the Revenue debt warehousing scheme as outlined in our report.

Hospitality and Retail are feeling the pressure

The hospitality and retail industries made up 40% of the total number of insolvencies in Q1 2024.

Hospitality had 45 insolvencies, while retail had 44. However, hospitality had over 3 times the equivalent business failure rate at 25 per 10,000 businesses, versus retail at 8 per 10,000 businesses.

This highlights that the hospitality is being affected much more than the retail sector, which has a higher volume of businesses in it. This is also reflective of what is happening in the economy as it’s been well publicised that a large number of restaurants have closed in recent months. Hospitality and Retail are also the two sectors carrying the most warehoused debt.

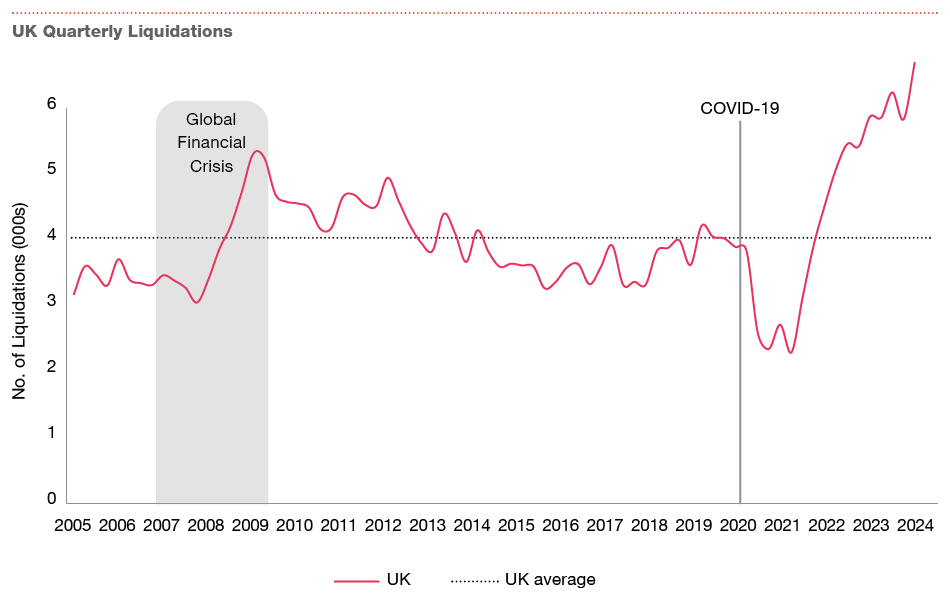

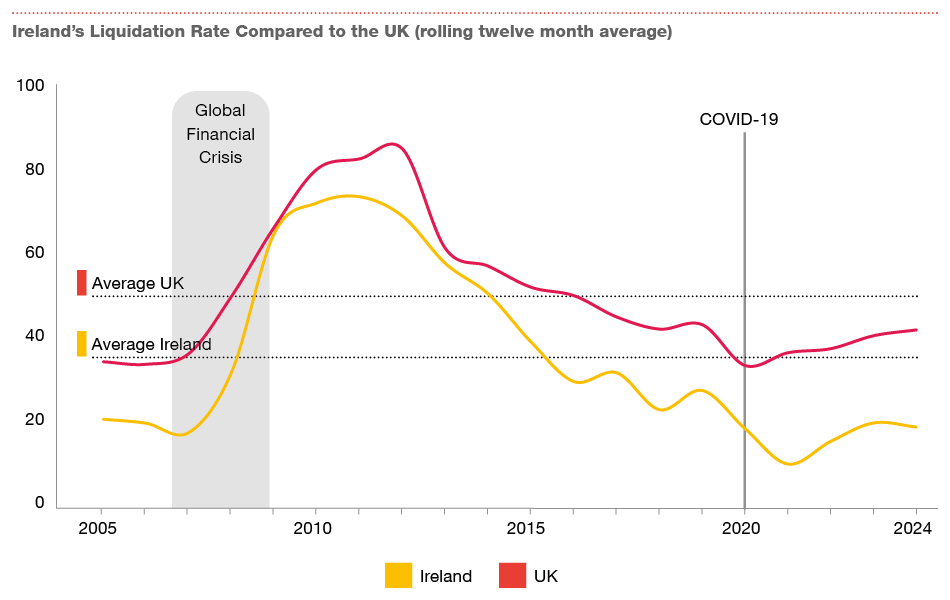

The UK recorded its highest quarterly levels of business failures since records began

The UK recorded 6,732 liquidations in Q4 2023, which is the largest number of business failures on record. Q4 2023 exceeded the previous quarterly highs set during 2022 and 2023. The liquidation rate in the UK continues to be almost double the equivalent Irish rate.

Revenue Debt Warehousing deadline approaching quickly on 1 May 2024

Businesses availing of the debt warehousing scheme have been given some breathing space. The interest rate has been reduced to 0% and businesses have until 1 May to agree a payment plan with Revenue.

The 0% interest rate and additional time is a much needed lifeline for businesses who are continuing to avail of this scheme. Over €1.7bn of tax debt remains warehoused by nearly 56,700 businesses.

Five ways to optimise your company’s cash culture

1. Make cash everyone’s business

Cash is bigger than the treasury and finance departments. They both have a key coordinating role in effectively managing cash, but it’s the operations of the business that make daily decisions that impact cash. Push cash up everyone’s agenda.

2. Cash can mean different things to different people, so make cash relevant to everyone

Having a common cash language across the organisation (operations and finance) is vital to instilling a proactive cash-conscious culture that produces:

reliable cash forecasting;

effective expenditure management and tactical actions;

cash reporting and incentivisation, tailored to audiences across the organisation;

management of cash tax and government incentives;

centralised management of true cash availability and foreign currency cash; and

effective management of banking and other financing facilities.

3. Forecast cash and conduct appropriately granular scenario planning

This should involve operations and finance teams, as they are essential in reflecting and understanding the real operational risks in the current volatile market.

4. Understand and share your minimum cash thresholds

This will help colleagues in the wider business manage their daily decisions and cash commitments (once the decision is made, the cash is committed).

5. Optimise supplier and customer working capital terms and relationships

This will help conserve and generate the cheapest form of cash available to you.

We are here to help you

The months and years ahead will be challenging for many Irish businesses, but we are ready to help you. Contact us today.

Menu