Key trends shaping Ireland’s E&M industry

Amid economic uncertainty, slower growth in consumer spending and heightened competition both domestically and internationally, we’ve seen Irish E&M revenues rise 3% from €6.2bn in 2023 to €6.4bn in 2024.

Global and Irish E&M industry growth trends

Globally, we expect the E&M industry to grow at 3.7% CAGR in the period. This boost will see the industry’s global revenues reach €3tn in 2029, up from €2.5tn in 2024. That’s according to our 26th annual Global Entertainment & Media Outlook 2005–2029.

Our findings also show that projected growth in the Irish market (3.3% CAGR) is behind the global forecast of 3.7% CAGR. This is mostly due to slower growth in the video gaming segment, which is driven by the decline of traditional gaming.

Irish Entertainment and Media Revenues

Source: Global Entertainment & Media Outlook 2025-2029, PwC, Omdia

We’ve identified three key drivers for E&M growth in Ireland.

1. Internet services

Ireland’s internet service revenues reached €2.6bn in 2024, accounting for more than 40% of Ireland’s total E&M revenue and is set to rise to €3.1bn in 2029. Fixed broadband subscriptions in Ireland grew year-on-year in 2024 by 5.7% to 1.9 million and are expected to grow at 5% CAGR over the five-year period to 2.4 million.

Mobile service revenue will increase at 3.4% CAGR, from €1.4bn in 2024 to €1.7bn in 2029, while fixed service revenue will show slower growth at 1.4% CAGR, rising to €1.3bn in 2029. Ireland has made significant strides in expanding 5G capabilities and since September 2020, all Irish mobile operators had launched commercial 5G services. 5G subscription penetration will overtake 4G in 2025 and is forecast to increase to a penetration of 182% by 2029.

The Government aims to extend 5G coverage to all populated areas by 2030. To support the expansion of 4G and 5G, operators began shutting down 3G networks in February 2023, with full decommissioning expected by the end of 2025. Mobile subscription growth and inflation-linked price adjustments will drive an increase in mobile service revenue at 3.4% CAGR over a five-year period. Mobile capex will grow at 2.6% CAGR over a five-year period as operators continue to invest in 5G expansion.

2. Internet advertising

Internet advertising revenue in Ireland will increase at 9.2% CAGR (versus 8.4% globally) between 2024 and 2029, rising from €1.2bn to €1.8bn. Year-on-year growth was 12.4% in 2024 and will continue in double-digits until 2026, eventually slowing to 5.2% by 2029. The fastest-growing market category is video advertising, which will grow at 12.6% CAGR to €198m over the forecast period.

Other display (traditional non-video ads) will also see strong growth, growing at 9.2% CAGR, while paid search will grow at 8.3% CAGR and classified (ads posted in a categorical listing of products or services) at 4% CAGR. The biggest market category is paid search, which accounted for 58.7% of total internet advertising revenue in 2024. This is followed by other display (28.7%), video (9.5%) and classified (3.1%).

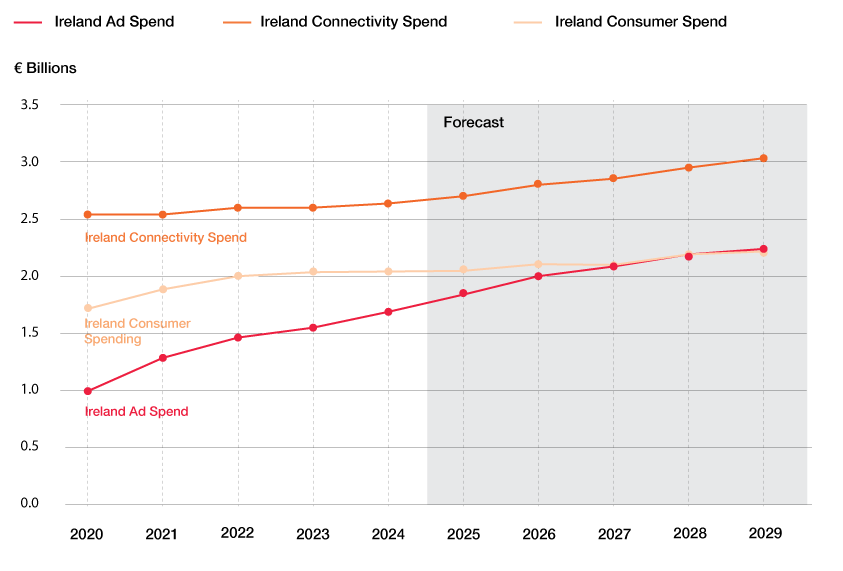

Globally, advertising and consumer revenue were more or less at parity in 2024. Consumer spend was ahead in Ireland at €2bn versus €1.7bn, but by 2029, advertising revenue is forecast to surpass consumer spending with a growth rate of 6.1% CAGR to €2.3bn. Meanwhile, consumer spend will slow to 1.9% CAGR and reach €2.2bn.

Ad spending surpasses consumer spending

Source: Global Entertainment & Media Outlook 2025-2029, PwC, Omdia

3. Video-on-demand

Ireland’s video-on-demand (VOD) market has more than doubled in size since 2020, reaching total revenue of €223m in 2024. While the COVID-19 pandemic lockdowns drove growth, there has been a longer-term trend away from linear broadcasts and towards on-demand content. Continued expansion has seen households increasingly “stack” multiple streaming services. This will ensure room for further growth, with total VOD revenue rising at 6.7% CAGR to reach €309m in 2029. At this time, subscription video-on-demand (SVOD) platforms will account for 85.1% of the total market, with advertising-supported video-on-demand (AVOD) platforms accounting for 11.3%.

However, as streaming service usage and consumer uptake rise, service providers face increased competition and challenges in getting consumers to pay more for digital goods and services. Irish subscriptions to VOD services are expected to rise to 2.6m in 2029, up from 1.9m in 2024 — a 6% CAGR (compared with 5.4% CAGR globally).

While SVOD advertising has not yet made inroads in Ireland, ad-supported tiers and hybrid models are evolving within the global VOD ecosystem as leading providers transition from rapid subscriber acquisition to sustainable growth and profitability.

Video on Demand Revenue by Segment

Source: Global Entertainment & Media Outlook 2025-2029, PwC, Omdia

Other areas of interest for Ireland

Irish video gaming industry to grow to €503m in 2029

Ireland’s total video games revenue was €397m in 2024 and it is expected to reach €503m by 2029 with a 4.8% CAGR. Year-on-year growth in 2024 was down slightly at -4.6%, resulting in a revenue decline of approximately €19m compared with 2023. Growth is expected to recover in 2025 and spike at 13% in 2026, before falling in 2027. From there, it will hold steady at around 3.5% for the final two years of the five-year forecast.

Social and casual gaming (online gaming) totalled €180m in 2024 and will rise to €240m in 2029 with a 5.9% CAGR. A paradigm shift in Ireland’s video games market will come in 2029, when social/casual gaming revenue will overtake traditional gaming (physical gaming on PCs and games consoles), which has to date been against the global trend. Although the larger portion of expected growth is provided by app-based social and casual gaming, in-app games advertising is rapidly becoming a notable presence in the sector, rising from €32.3m in 2024 to €51.1m by 2029, increasing at 9.8% CAGR.

Offline entertainment, including cinema and live music, continues to grow steadily

Irish cinema revenue reached €100.6m in 2024. This modest year-on-year growth from €99.8m in 2023 signals a mature but growing segment, cooling off from record growth in 2021/2022. Ireland’s cinema industry is forecasted to grow 4.7% CAGR over the forecast period, compared with 4.1% CAGR globally. The number of cinema admissions in Ireland is expected to grow from 11.32m in 2024 to 12.76m in 2029, with a CAGR of 2.4%.

Irish box office results are frequently grouped together with those of the UK, and films are generally released across both territories. However, the Irish film and television industry supports 15,000 full-time jobs and its gross value added (GVA) is worth over €1bn.

According to data released by the national film agency, Screen Ireland, total production spend generated by the Irish screen industry in 2024 was valued at over €430m, representing a 33% increase on 2023 figures. The country’s long-standing Section 481 tax credit is worth 32% of eligible Irish spend and continues to attract international projects.

Ireland’s total music and radio revenue was worth €463mn in 2024, up from €443mn in 2023. It is forecast to rise at a 2.2% CAGR to total €517mn in 2029 (compared to 2.4% globally). Ireland’s Music Revenue accounted for €355mn in 2024, with 66% of that made up of live music revenue. Live music revenue reached €241mn for Ireland in 2024, up nearly 5% from 2023. Live music revenue is expected to grow at 2% CAGR to €266mn in 2029, compared with 2.3% globally.

Revenues continue to shift in the E&M industry

Digital advertising dominates the fastest-growing segments, while physical media lags. A look at the three fastest-growing and fastest-declining Irish E&M metrics over the next five years reveals how value is in motion in this industry.

As the chart below shows, internet advertising — whether generated from pure-play sources or from digital advertising revenues associated with other segments, such as AVOD — dominates at the top end.

Several of the fastest-declining metrics, including physical PC games and print advertising in newspapers and magazines, have roots in physical media.

Fastest-growing and fastest-declining sub-segments by CAGR

Source: Global Entertainment & Media Outlook 2025-2029, PwC, Omdia

AI: From efficiency to value creation

AI is already having a significant impact on major E&M sectors. Advertising, in particular, will be aided with hyper-personalisation of content to end-users more likely to purchase advertised products, while AI technologies may reduce cost barriers to entry in advertising for major and small corporates — potentially delivering greater efficiencies and cost savings, or spurring greater competition from smaller actors in the industry.

Another fast-growing impact of AI is on production processes for movies, video games and music, with AI presenting an ability to drastically reduce risk and development time when it comes to creating and editing content. AI is also impacting the point of delivery for games, with video game companies now using AI to predict the likely churn point of customers in different demographics and target them with ads for the next game at the right time.

Overall, companies are investing in AI and experimenting with its potential applications, while contending with regulatory frameworks and safeguards put in place to protect content creators and intellectual property. But the much greater long-term impact from emerging technology comes when it brings the ability to operate in new ways, create new business models and access previously untapped revenue streams. With AI, this value-creating potential is arguably greater than with any previous technology and will represent a significant influence on the E&M industry considering it has always been at the forefront of technological innovation and application.

We’re here to help, so you can stay ahead of the emerging tech curve

Our Technology, Media and Telecommunications (TMT) team at PwC Ireland brings deep expertise and fresh thinking to your challenges. Whether you need to capitalise on growth opportunities, leverage AI or reinvent your business model, we’ll share our industry know-how and innovative solutions so you can move forward with confidence and achieve your strategic goals. Get in touch with us today to learn more about how we can help you stay ahead and thrive in this dynamic industry

Ireland’s Entertainment & Media Outlook 2025–2029

Unleashing agility in a rapidly changing world.

Contact us

Menu